what is suta tax texas

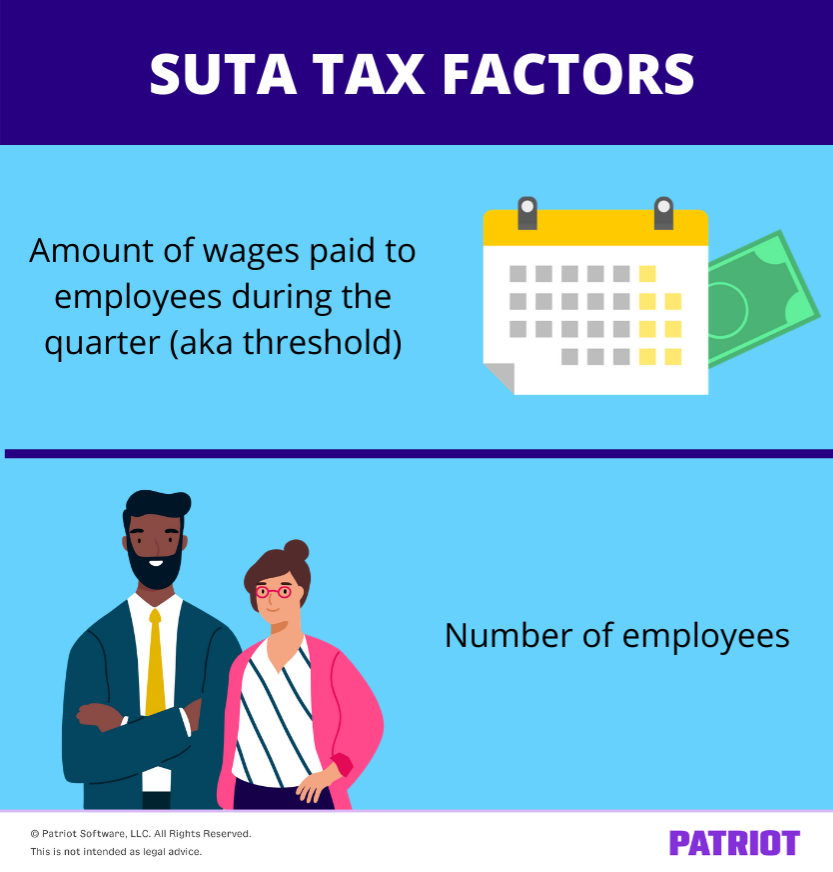

Timeline for receiving unemployment tax number. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

Texas Sales Tax Small Business Guide Truic

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

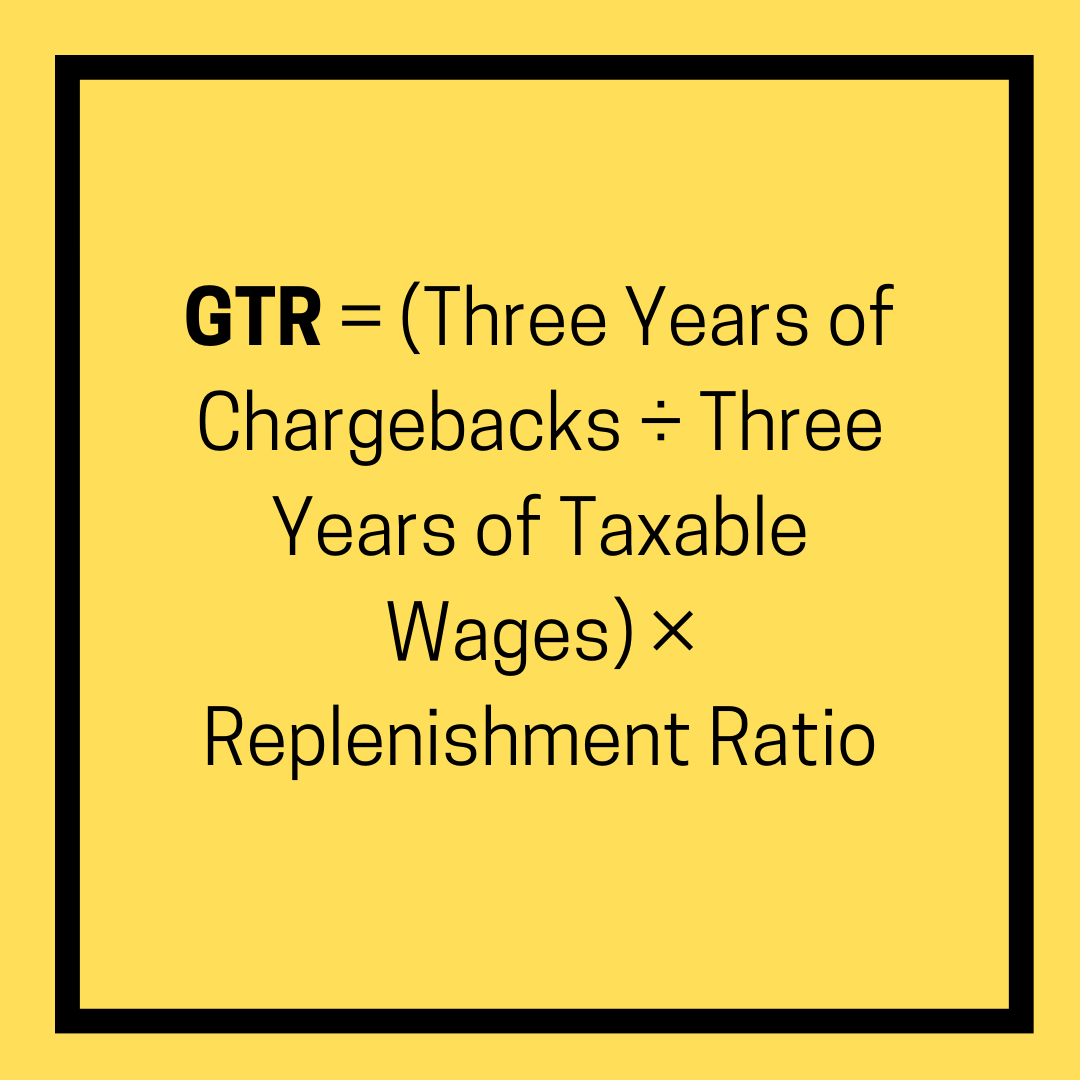

. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. Calculating SUTA. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631.

General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. Heres how an employer in Texas would.

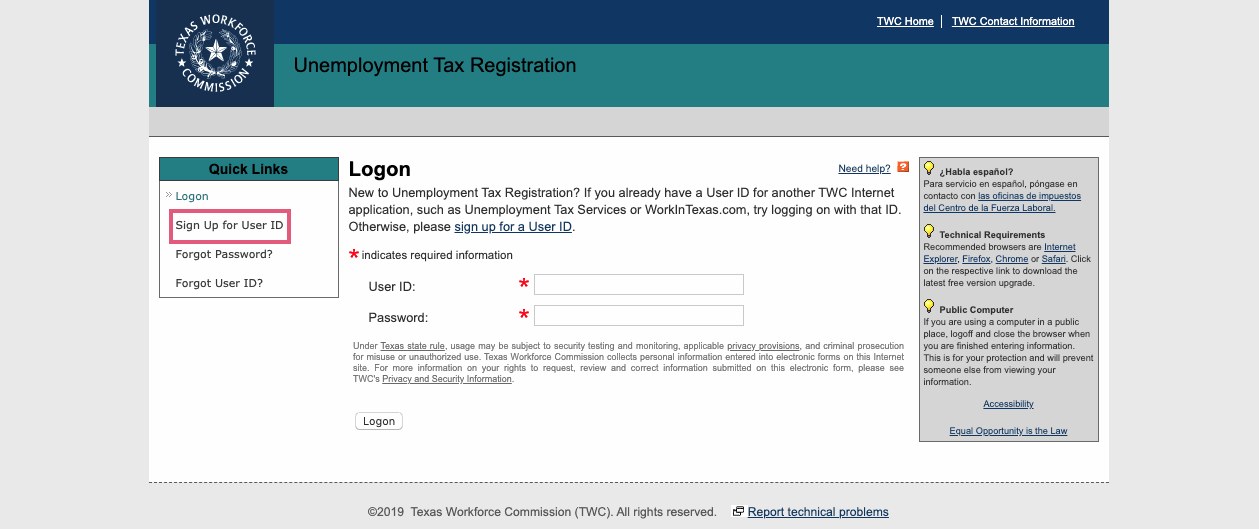

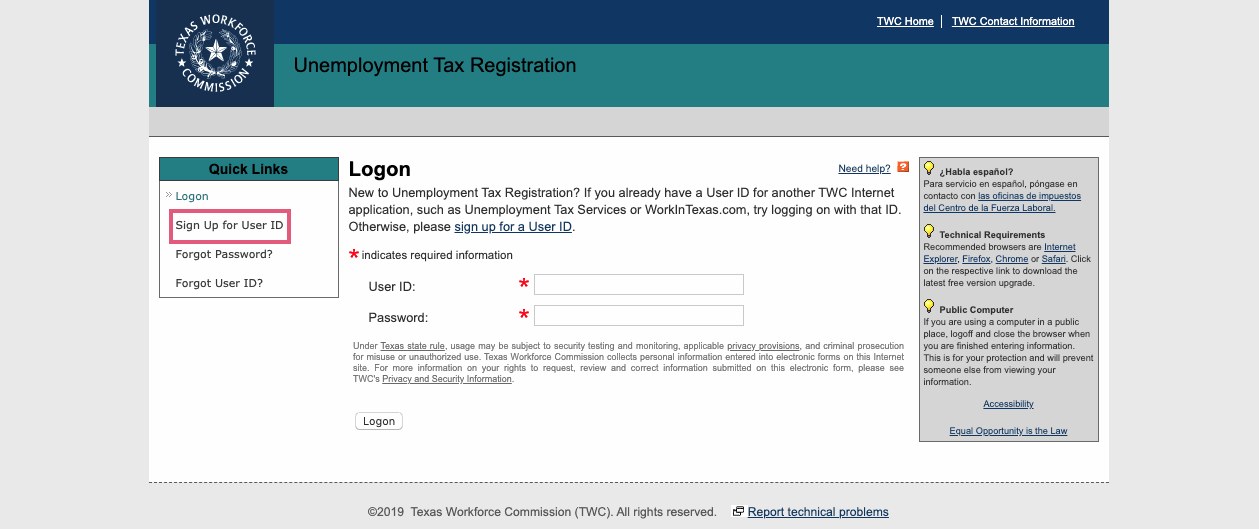

SUTA was established to provide unemployment benefits to. The states SUTA wage base is 7000 per. Register immediately after employing a worker.

The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. In the case of the state unemployment tax this is a deduction made by employers. An employers SUI rate is the sum of five components.

The state typically issues a SUTA tax. Who pays Suta in Texas. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees. Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes. Assume that your company receives a good assessment and your.

Employer registration requirement s. The SUTA tax is a type of payroll tax deducted from paychecks and remitted to the government.

Texas Unemployment Agency S Bank Account Drained Now Borrowing Federal Money To Pay Out Of Work Texans Wfaa Com

Twc Expands Skill Enhancements To Ui Claimants Vbr

State Payroll Tax State Payroll State Employment Tax Payroll Tax

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

Usa State Payroll Rates Resources State Of Texas Unemployment Insurance Reporting Payments

10 Facts Texas Employers Should Know About Unemployment

You Have To Pay Taxes On Unemployment Checks What You Need To Know

Unemployment Tax Changes Throughout The Country In 2022 And 2023 First Nonprofit Companies

Suta Tax Requirements For Employers State By State Guide

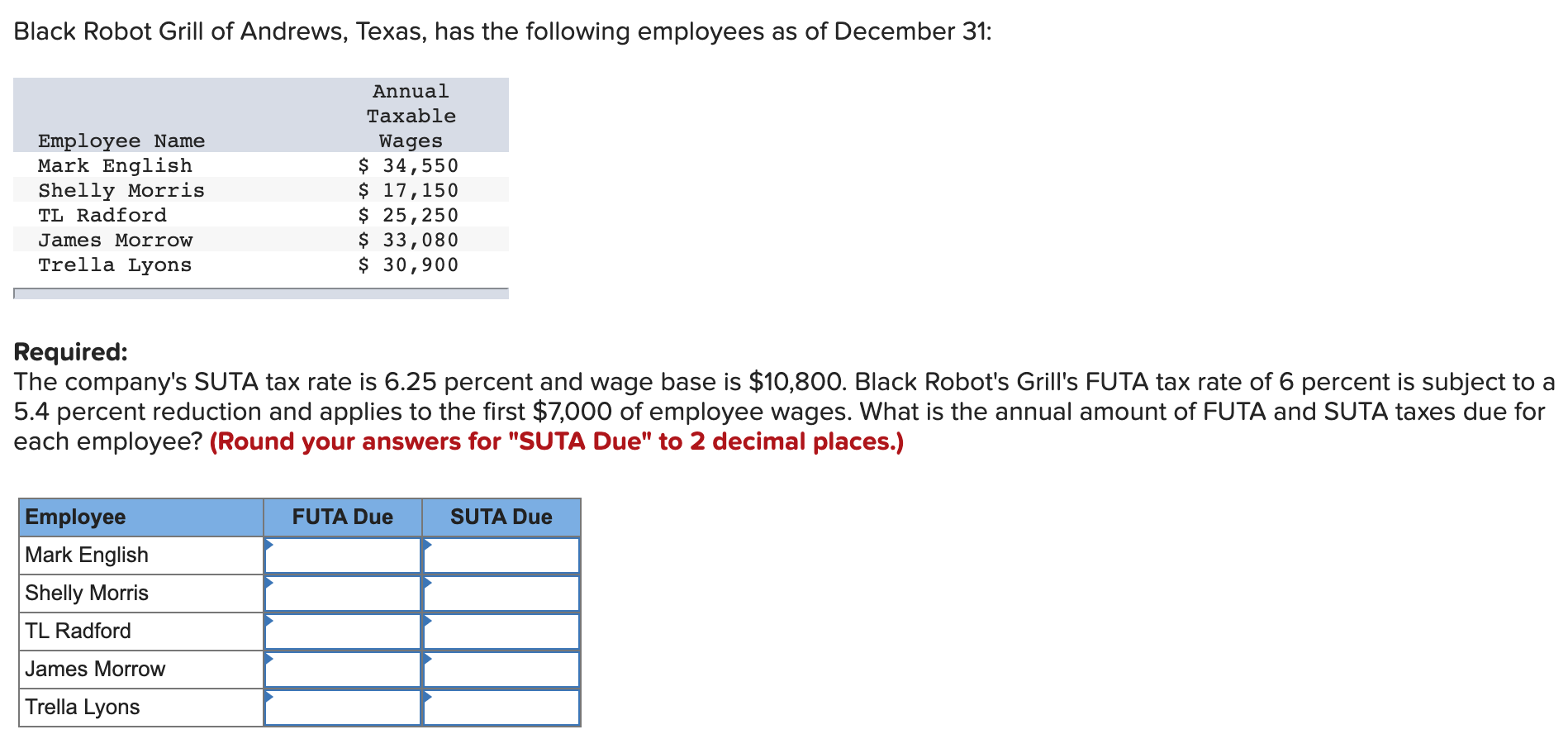

Solved Black Robot Grill Of Andrews Texas Has The Chegg Com

Twc Finally Issues 2021 Unemployment Tax Rates

How To Apply For Unemployment In Texas 10 Steps With Pictures

Sammy Carolina What Is Unemployment Insurance Temporary Assistance Paid Through An Employer Paid Tax Paid Into A Fund To Provide Unemployment Ppt Download

A Follow Up Audit Report On Unemployment Insurance Tax At The Texas Workforce Commission The Portal To Texas History

A Complete Guide To Texas Payroll Taxes

Unemployment Claims Could Drive Up Taxes For Already Hurting Texas Businesses Keye

Disability Rights Texas Are You One Of The Over 23 Million U S Workers That Filed For Unemployment In 2020 This Week The Irs Announced That They Will Be Recalculating Taxes On

Taxes On Unemployment Benefits A State By State Guide Kiplinger